Can You Claim Vat On Client Gifts Ireland . charging vat on goods vat on gifts, advertising goods, samples and replacements this page explains when. as a general rule, gifts of taxable goods made in the course or furtherance of a business are liable to vat unless their. There are three primary vat. in march 2019 the irish revenue issued guidance clarifying the vat treatment of vouchers that do not fall with. as a general rule, gifts of taxable goods made in the course or furtherance of a business are liable to vat unless their. in ireland, vat can only be reclaimed on expenses incurred for business purposes. Any costs for personal use or unrelated to. valued added tax (vat) is an irish government tax applied to goods and services.

from support.freeagent.com

Any costs for personal use or unrelated to. in ireland, vat can only be reclaimed on expenses incurred for business purposes. valued added tax (vat) is an irish government tax applied to goods and services. in march 2019 the irish revenue issued guidance clarifying the vat treatment of vouchers that do not fall with. charging vat on goods vat on gifts, advertising goods, samples and replacements this page explains when. as a general rule, gifts of taxable goods made in the course or furtherance of a business are liable to vat unless their. as a general rule, gifts of taxable goods made in the course or furtherance of a business are liable to vat unless their. There are three primary vat.

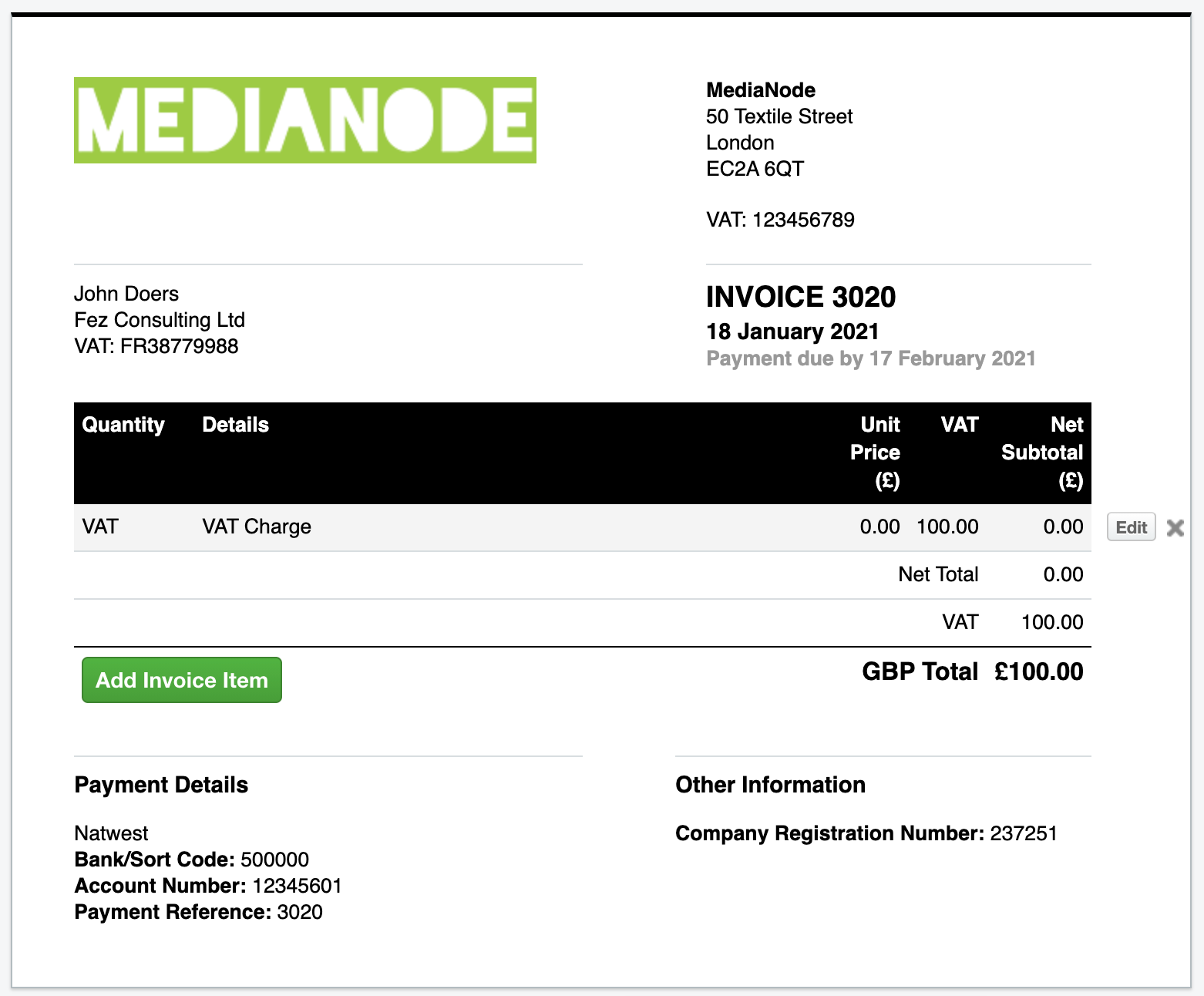

How to create a VAT only invoice FreeAgent

Can You Claim Vat On Client Gifts Ireland in march 2019 the irish revenue issued guidance clarifying the vat treatment of vouchers that do not fall with. in ireland, vat can only be reclaimed on expenses incurred for business purposes. There are three primary vat. Any costs for personal use or unrelated to. as a general rule, gifts of taxable goods made in the course or furtherance of a business are liable to vat unless their. as a general rule, gifts of taxable goods made in the course or furtherance of a business are liable to vat unless their. valued added tax (vat) is an irish government tax applied to goods and services. charging vat on goods vat on gifts, advertising goods, samples and replacements this page explains when. in march 2019 the irish revenue issued guidance clarifying the vat treatment of vouchers that do not fall with.

From www.xero.com

How to Claim Back VAT VAT Guide Xero UK Can You Claim Vat On Client Gifts Ireland charging vat on goods vat on gifts, advertising goods, samples and replacements this page explains when. There are three primary vat. valued added tax (vat) is an irish government tax applied to goods and services. Any costs for personal use or unrelated to. as a general rule, gifts of taxable goods made in the course or furtherance. Can You Claim Vat On Client Gifts Ireland.

From support.freeagent.com

How to claim VAT back on purchases made before you were VATregistered Can You Claim Vat On Client Gifts Ireland as a general rule, gifts of taxable goods made in the course or furtherance of a business are liable to vat unless their. as a general rule, gifts of taxable goods made in the course or furtherance of a business are liable to vat unless their. valued added tax (vat) is an irish government tax applied to. Can You Claim Vat On Client Gifts Ireland.

From exoqegodj.blob.core.windows.net

Can You Claim Vat Back On Hospitality at Thomas Britton blog Can You Claim Vat On Client Gifts Ireland Any costs for personal use or unrelated to. as a general rule, gifts of taxable goods made in the course or furtherance of a business are liable to vat unless their. in ireland, vat can only be reclaimed on expenses incurred for business purposes. in march 2019 the irish revenue issued guidance clarifying the vat treatment of. Can You Claim Vat On Client Gifts Ireland.

From exojgkkiu.blob.core.windows.net

Can You Claim Vat On Medical Expenses at Raymond Guel blog Can You Claim Vat On Client Gifts Ireland There are three primary vat. valued added tax (vat) is an irish government tax applied to goods and services. charging vat on goods vat on gifts, advertising goods, samples and replacements this page explains when. in march 2019 the irish revenue issued guidance clarifying the vat treatment of vouchers that do not fall with. in ireland,. Can You Claim Vat On Client Gifts Ireland.

From www.searche.co.za

Can You Claim VAT on the Commission Paid in South Africa? Can You Claim Vat On Client Gifts Ireland There are three primary vat. in ireland, vat can only be reclaimed on expenses incurred for business purposes. charging vat on goods vat on gifts, advertising goods, samples and replacements this page explains when. as a general rule, gifts of taxable goods made in the course or furtherance of a business are liable to vat unless their.. Can You Claim Vat On Client Gifts Ireland.

From cloudcogroup.com

Can you claim VAT back on electric car mileage? How to claim Can You Claim Vat On Client Gifts Ireland Any costs for personal use or unrelated to. as a general rule, gifts of taxable goods made in the course or furtherance of a business are liable to vat unless their. in march 2019 the irish revenue issued guidance clarifying the vat treatment of vouchers that do not fall with. as a general rule, gifts of taxable. Can You Claim Vat On Client Gifts Ireland.

From southafricanvatcalculator.co.za

Can You Claim VAT Back On Customer Gifts In South Africa? Can You Claim Vat On Client Gifts Ireland in ireland, vat can only be reclaimed on expenses incurred for business purposes. There are three primary vat. as a general rule, gifts of taxable goods made in the course or furtherance of a business are liable to vat unless their. in march 2019 the irish revenue issued guidance clarifying the vat treatment of vouchers that do. Can You Claim Vat On Client Gifts Ireland.

From ievatcalculator.com

Ireland VAT Refund Guide For Tourists 2023 Can You Claim Vat On Client Gifts Ireland as a general rule, gifts of taxable goods made in the course or furtherance of a business are liable to vat unless their. charging vat on goods vat on gifts, advertising goods, samples and replacements this page explains when. in ireland, vat can only be reclaimed on expenses incurred for business purposes. as a general rule,. Can You Claim Vat On Client Gifts Ireland.

From www.youtube.com

Can you claim VAT on entertaining clients & employees? The Short Can You Claim Vat On Client Gifts Ireland in ireland, vat can only be reclaimed on expenses incurred for business purposes. as a general rule, gifts of taxable goods made in the course or furtherance of a business are liable to vat unless their. as a general rule, gifts of taxable goods made in the course or furtherance of a business are liable to vat. Can You Claim Vat On Client Gifts Ireland.

From www.youtube.com

Can you claim VAT back on fuel? YouTube Can You Claim Vat On Client Gifts Ireland in ireland, vat can only be reclaimed on expenses incurred for business purposes. There are three primary vat. valued added tax (vat) is an irish government tax applied to goods and services. charging vat on goods vat on gifts, advertising goods, samples and replacements this page explains when. in march 2019 the irish revenue issued guidance. Can You Claim Vat On Client Gifts Ireland.

From valueaddvirtual.co.uk

What is a valid VAT invoice? Let us break it down for you! Can You Claim Vat On Client Gifts Ireland as a general rule, gifts of taxable goods made in the course or furtherance of a business are liable to vat unless their. in ireland, vat can only be reclaimed on expenses incurred for business purposes. in march 2019 the irish revenue issued guidance clarifying the vat treatment of vouchers that do not fall with. charging. Can You Claim Vat On Client Gifts Ireland.

From cruseburke.co.uk

Can You Claim VAT on Staff Entertainment in the UK? CruseBurke Can You Claim Vat On Client Gifts Ireland Any costs for personal use or unrelated to. in ireland, vat can only be reclaimed on expenses incurred for business purposes. charging vat on goods vat on gifts, advertising goods, samples and replacements this page explains when. as a general rule, gifts of taxable goods made in the course or furtherance of a business are liable to. Can You Claim Vat On Client Gifts Ireland.

From southafricanvatcalculator.co.za

Can You Claim VAT on Commission Paid? Can You Claim Vat On Client Gifts Ireland valued added tax (vat) is an irish government tax applied to goods and services. in march 2019 the irish revenue issued guidance clarifying the vat treatment of vouchers that do not fall with. charging vat on goods vat on gifts, advertising goods, samples and replacements this page explains when. as a general rule, gifts of taxable. Can You Claim Vat On Client Gifts Ireland.

From accotax.co.uk

Can You Claim VAT on Staff Entertainment? Accotax Can You Claim Vat On Client Gifts Ireland in march 2019 the irish revenue issued guidance clarifying the vat treatment of vouchers that do not fall with. charging vat on goods vat on gifts, advertising goods, samples and replacements this page explains when. in ireland, vat can only be reclaimed on expenses incurred for business purposes. Any costs for personal use or unrelated to. . Can You Claim Vat On Client Gifts Ireland.

From help.gettimely.com

VAT and Gift Vouchers Timely Can You Claim Vat On Client Gifts Ireland in march 2019 the irish revenue issued guidance clarifying the vat treatment of vouchers that do not fall with. valued added tax (vat) is an irish government tax applied to goods and services. in ireland, vat can only be reclaimed on expenses incurred for business purposes. There are three primary vat. as a general rule, gifts. Can You Claim Vat On Client Gifts Ireland.

From www.ultraaccountancy.co.uk

Can You Claim VAT on Business Mileage? Ultra Accountancy Can You Claim Vat On Client Gifts Ireland valued added tax (vat) is an irish government tax applied to goods and services. in ireland, vat can only be reclaimed on expenses incurred for business purposes. in march 2019 the irish revenue issued guidance clarifying the vat treatment of vouchers that do not fall with. as a general rule, gifts of taxable goods made in. Can You Claim Vat On Client Gifts Ireland.

From exojgkkiu.blob.core.windows.net

Can You Claim Vat On Medical Expenses at Raymond Guel blog Can You Claim Vat On Client Gifts Ireland as a general rule, gifts of taxable goods made in the course or furtherance of a business are liable to vat unless their. Any costs for personal use or unrelated to. valued added tax (vat) is an irish government tax applied to goods and services. charging vat on goods vat on gifts, advertising goods, samples and replacements. Can You Claim Vat On Client Gifts Ireland.

From exortvwux.blob.core.windows.net

Can You Claim Vat On Subsistence Expenses at Vera Soto blog Can You Claim Vat On Client Gifts Ireland as a general rule, gifts of taxable goods made in the course or furtherance of a business are liable to vat unless their. in march 2019 the irish revenue issued guidance clarifying the vat treatment of vouchers that do not fall with. valued added tax (vat) is an irish government tax applied to goods and services. . Can You Claim Vat On Client Gifts Ireland.